| Year | Cash Flow | |

|---|---|---|

What is an NPV Calculator?

An NPV Calculator is an online tool designed to compute the Net Present Value (NPV). This tool proves invaluable in evaluating the viability of projects, businesses, or investment proposals.

By assessing the NPV, it helps determine whether an idea is beneficial or unfavorable. A positive NPV indicates that the idea will generate value and is regarded as favorable, while a negative NPV suggests that the idea will result in value depletion and is considered unfavorable.

How To Calculate NPV Using the NPV Calculator in 4 Steps

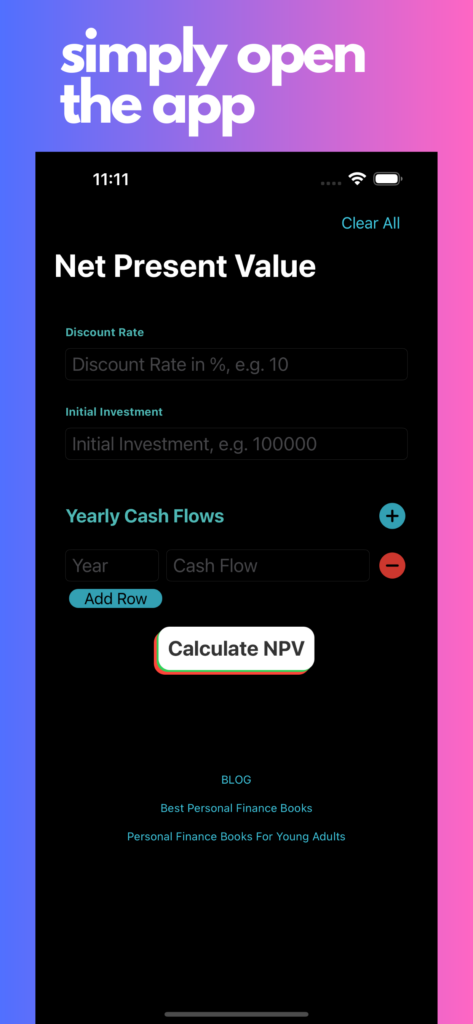

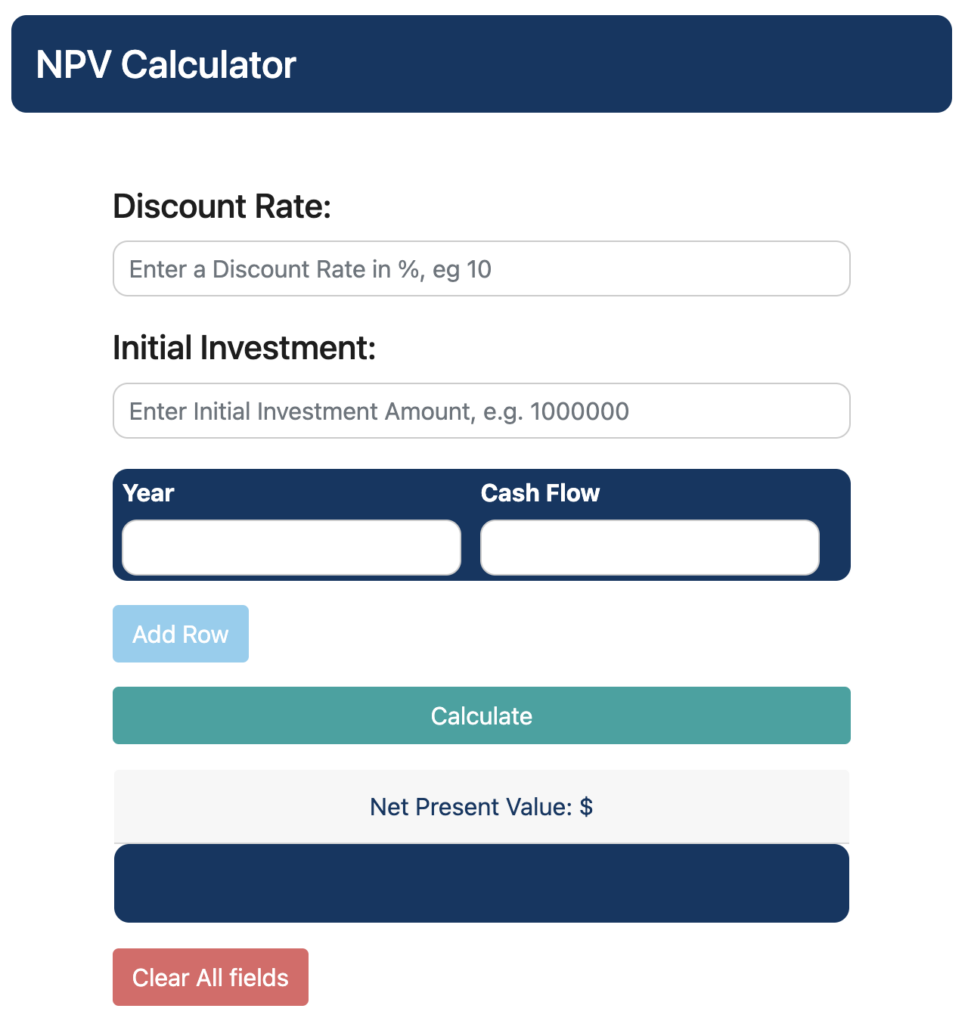

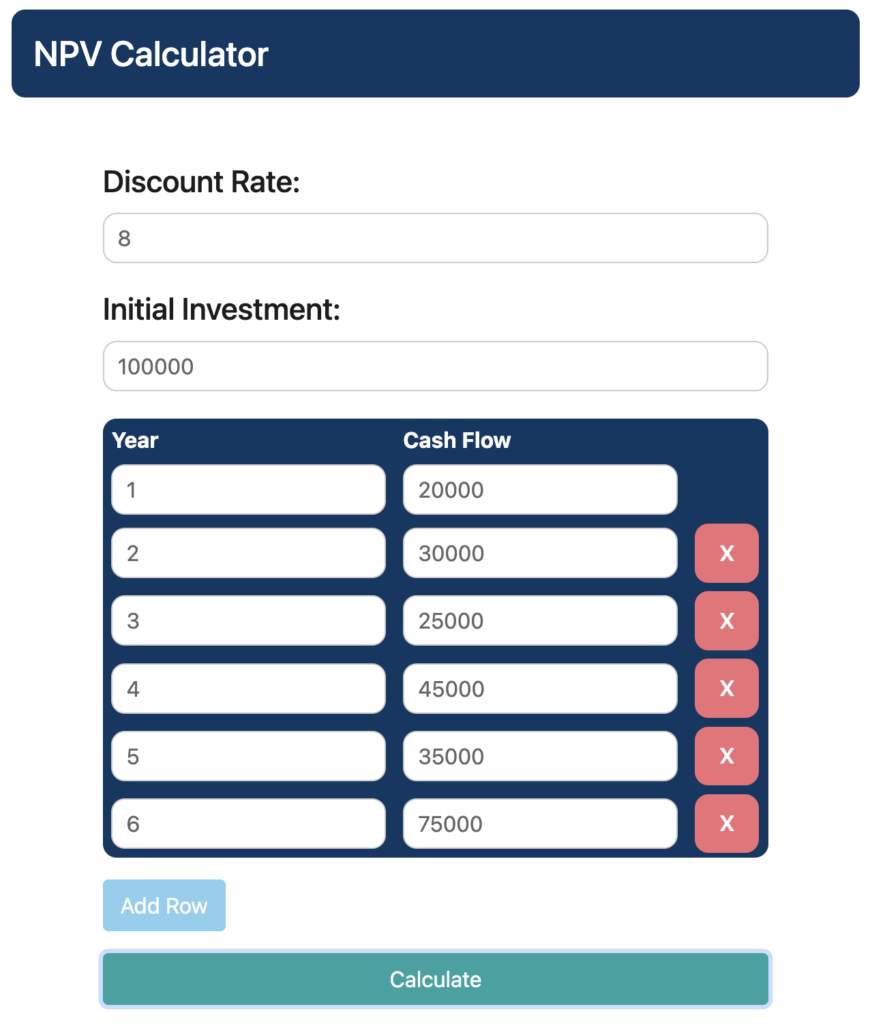

Suppose I possess a capital of $100,000 for potential investment in a new venture. In order to ascertain the viability of this investment, the first step is to access the NPV Calculator, an easily accessible web-based tool comprising essential fields such as Discount Rate, Initial Investment, Year, and Cash Flow.

Step 1.

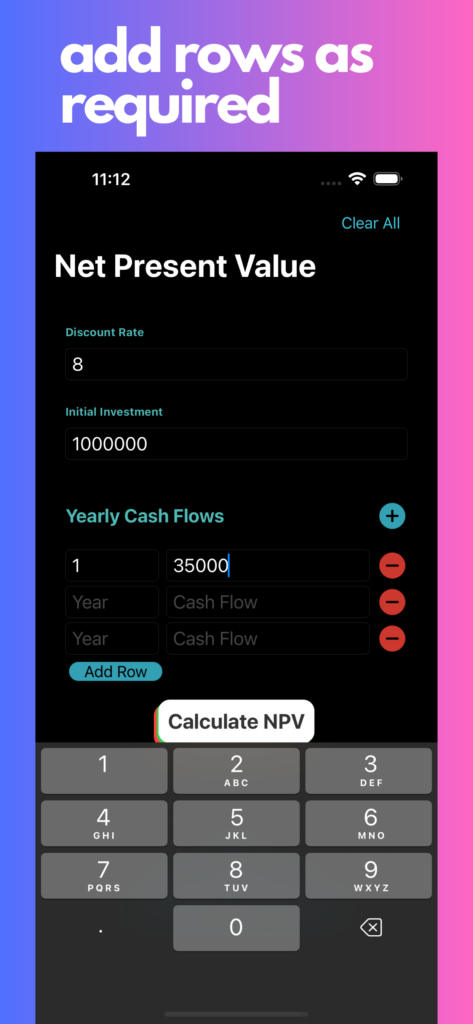

Open the NPV Calculator to calculate the NPV Online. The layout of the calculator should look like the image below with fields for Discount Rate, Initial Investment, and cash flows by year.

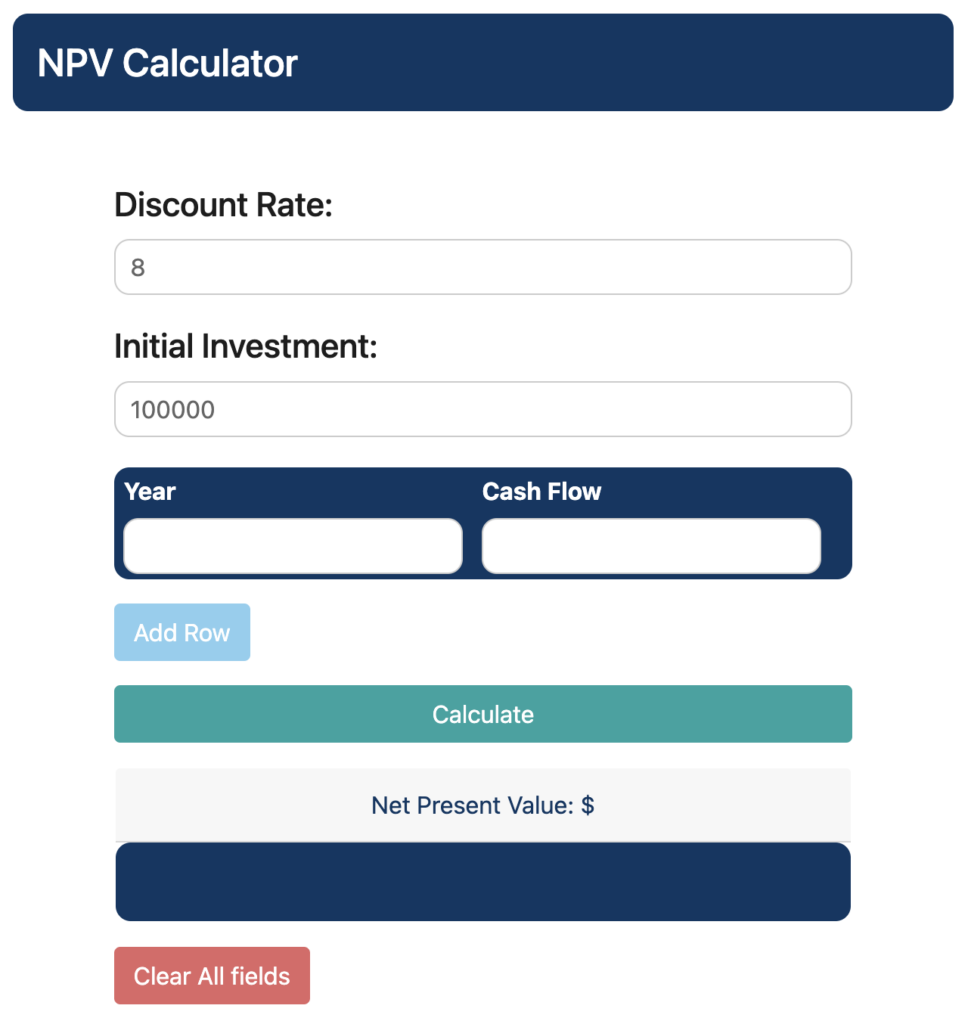

Step 2.

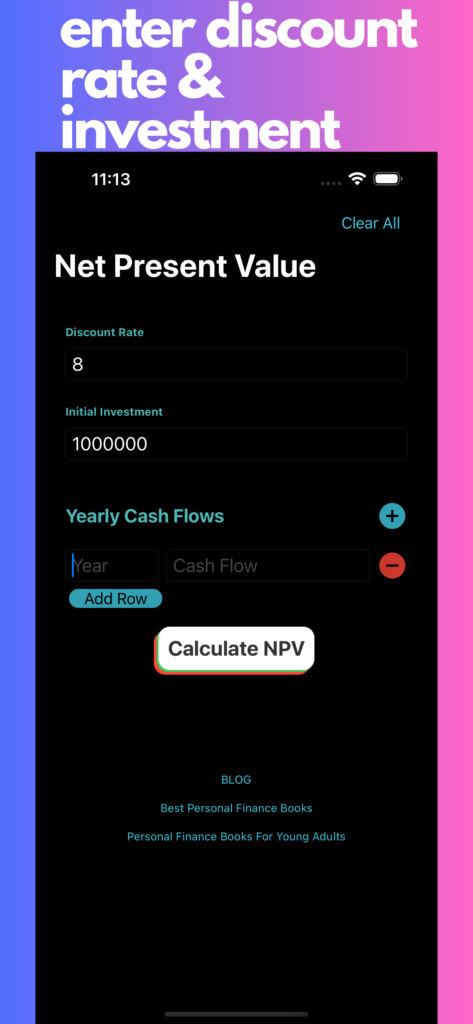

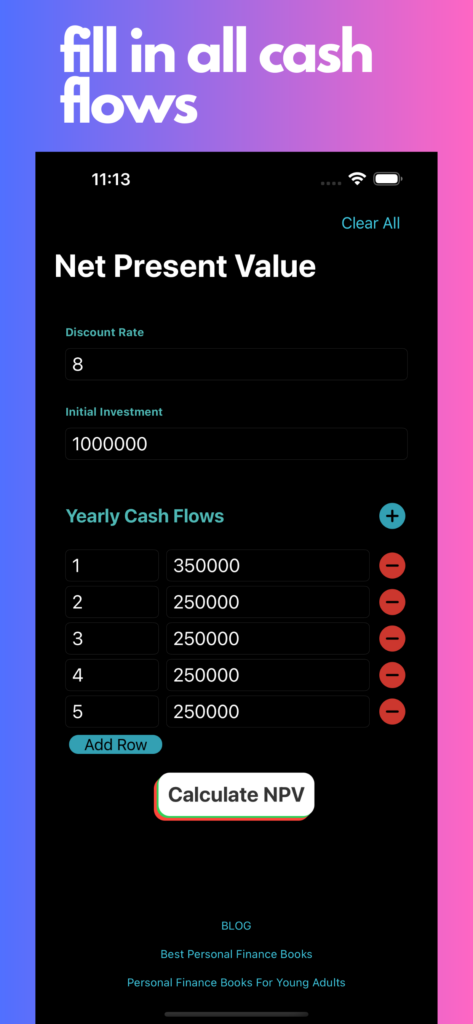

Input the values for the discount rate and the initial investment.

In my particular scenario, should I choose not to invest my $100,000 in this business venture, I would instead allocate the funds towards a broad market index fund, such as an S&P 500 ETF. Anticipating an annual return of 8% from the S&P 500 ETF over the upcoming years, I will consider this rate as my discount rate for calculations.

Furthermore, my initial investment amount stands at $100,000, so I’ll input that without the need for including symbols like ‘$’ or ‘,’ when utilizing the NPV Calculator.

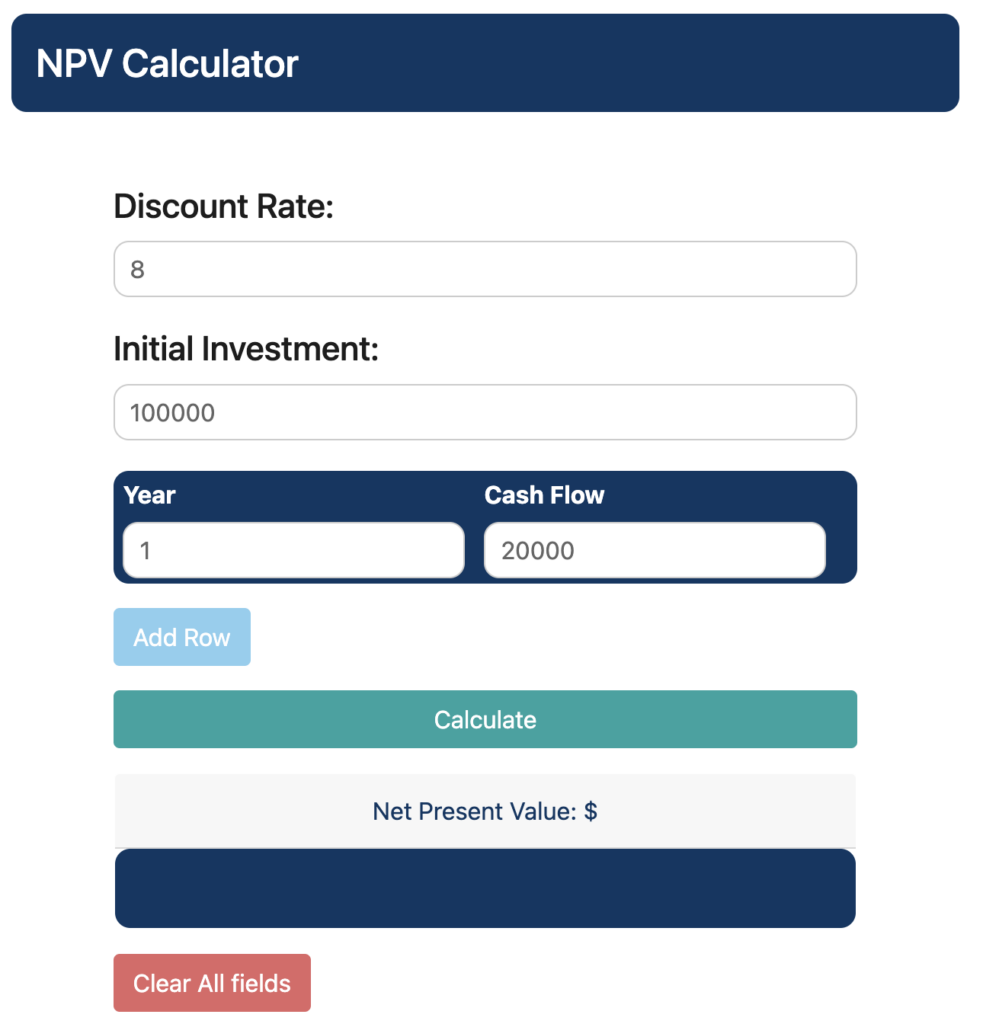

Step 3.

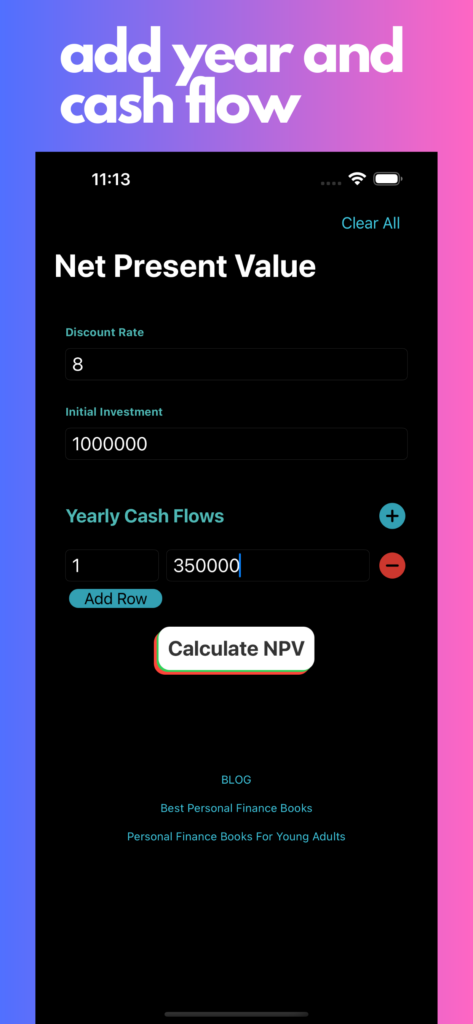

Input the annual forecasts for cash flow from the project or business.

Cash flow can be represented as either positive or negative. Positive cash flows arise when the business generates profits (fingers crossed!). On occasion, the business may necessitate additional investments during certain years, resulting in negative cash flow.

When utilizing the NPV Calculator, you have the flexibility to incorporate additional years of cash flow by using the ‘Add Row’ button.

For my proposed business investment, I have projected the following cash flows by year:

- Year 1: $20,000

- Year 2: $30,000

- Year 3: $25,000

- Year 4: $45,000

- Year 5: $35,000

- Year 6: $75,000 (I dispose off the business after this)

Step 4.

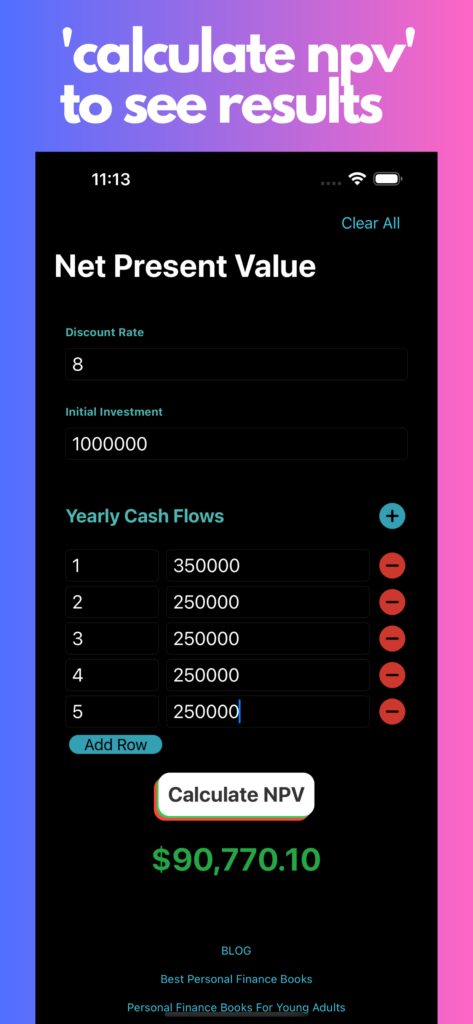

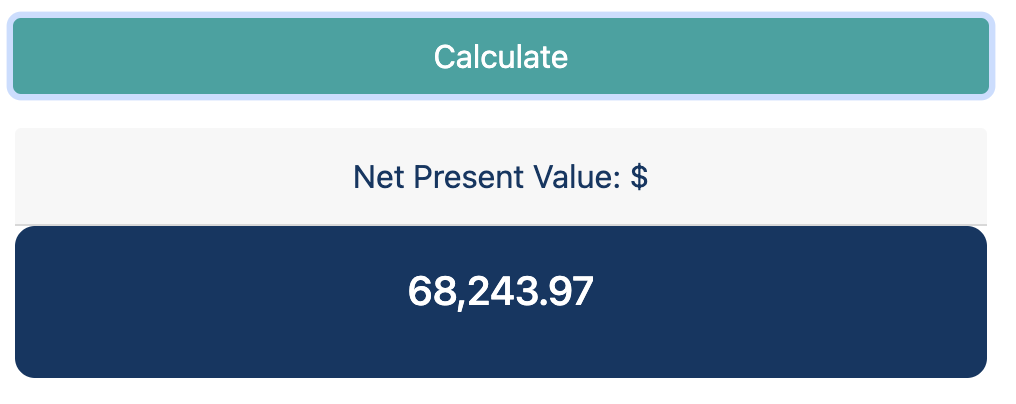

After inputting all the values, click on the ‘Calculate’ button at the bottom.

The NPV or the Net Present Value of this project comes out to be $68,244.

By considering all the aforementioned assumptions, it can be deduced that investing in this business yields a higher profitability of $68,000 compared to investing in the S&P 500 Index when measured using the present value of the dollar.

Understanding NPV in Finance: What is NPV or Net Present Value?

NPV, which stands for Net Present Value, is a fundamental concept in finance.

Before delving into the details of NPV, let’s establish some basic finance concepts.

Conceptually, a dollar received today holds more value than a dollar received in the distant future. This is because investing the dollar today allows it to grow over time. This concept is known as the “time value of money.”

The Time Value of Money

The time value of money refers to the notion that money available in the present is more valuable than the same amount of money in the future. This is due to the potential for the present money to generate interest or increase in value over time.

Present Value

Now that we understand that a dollar today is worth more than a dollar received years later, it becomes evident that the value of money diminishes over time.

When planning a business or investment, it is essential to project the cash flows expected in each year. However, an upfront investment is required to initiate the business. As a result, cash is distributed across various years, from year 0 to year 5. How do we compare these amounts?

By considering the time value of money, we can estimate the present value of future cash flows in terms of today’s dollar value.

To estimate the current value or present value of future cash flows, an adjustment factor known as the “discount rate” is applied.

The Discount Rate

The discount rate is not a universal constant. It varies depending on the context and is used to calculate the present value.

A helpful approach to determining the discount rate is considering alternative investment options and their expected returns given a similar level of risk. For instance, individual investors might consider the expected returns of investing in an S&P500 Index ETF, while a venture capital fund might have different risk tolerances and, consequently, a distinct discount rate.

The discount rate is applied to future cash flows to approximate their value in today’s dollar terms.

Calculating NPV

With an understanding of the time value of money and the use of a discount rate to evaluate future cash flows as present values, we can now ascertain the net present value.

- Upon making an investment today, we already know the present value of that investment.

- By applying the discount rate, we can calculate the present value of all future cash flows.

All dollar amounts are now in terms of today’s value. To calculate the net present value, we sum the present values of future cash flows and subtract the initial investment.

And there we have it – the net present value.

To simplify these calculations, an NPV calculator can handle all these complicated computations efficiently and easily.

NPV Formula Simplified

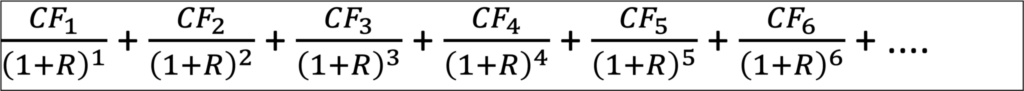

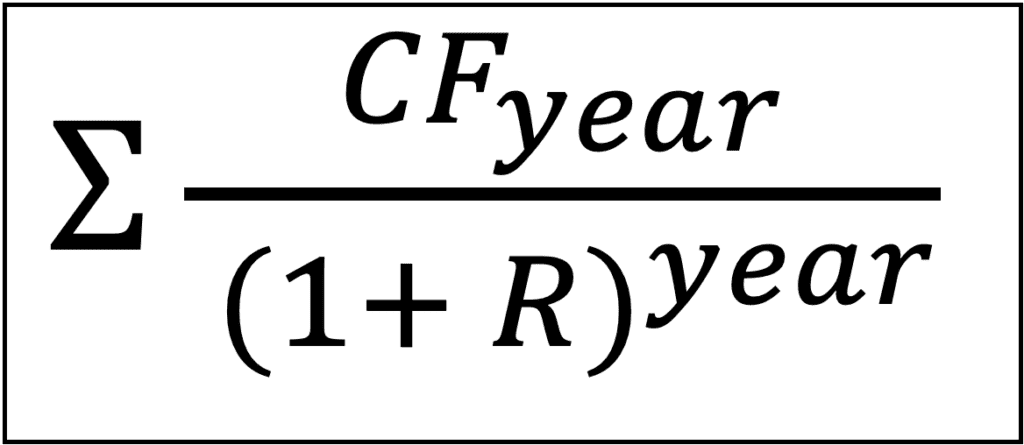

The formula for calculating the present value of future cash flows involves the use of the discount rate and the number of years the cash flow is expected to occur.

The Present Value formula is as follows:

Present Value =

Where:

- CF represents the cash flow for a specific period.

- CF1 refers to the cash flow in Year 1, CF2 in Year 2, and so on.

- R denotes the discount rate.

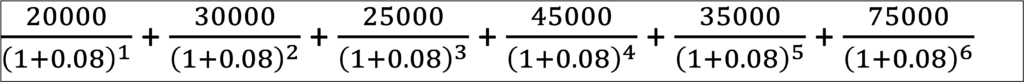

Applying my cash flow values to the formula, the Present Value amounts to $184,008.

To determine the net present value, I need to subtract the initial investment:

Net Present Value = Present Value – Initial Investment NPV = $168,244 – $100,000 = $68,244

In a more concise representation, the NPV formula is:

where:

- CF represents the cash flow for the year.

- R represents the discount rate.

The summation takes place for all years where cash flows exist, including Year 0, when the initial investment is made.

NPV Calculator App (Available on Apple App Store)

NPV Calculator – Financial Analysis Made Easy

The NPV Calculator is the ultimate tool for financial enthusiasts, entrepreneurs, and decision-makers who want to evaluate the profitability of their investment projects or business ideas. Whether you’re a seasoned investor or a beginner in the world of finance, this app provides you with a comprehensive and user-friendly platform to calculate the net present value (NPV) effortlessly.

Key Features:

Effortless NPV Calculation: Simplify complex financial calculations with ease. Enter the initial investment, discount rate, and expected cash flows, and let the app calculate the net present value for you. Save time and minimize errors by relying on accurate and efficient calculations.

Project Evaluation: Analyze the feasibility of investment projects or potential business ventures by calculating the NPV. Make informed decisions based on accurate financial data, and assess the profitability of your ideas before diving in. Understand the implications of your investment decisions and determine the viability of your projects.

Customizable Inputs: Tailor the inputs according to your specific needs. Modify the initial investment, discount rate, or projected cash flows to simulate different scenarios and evaluate the potential outcomes. Gain valuable insights into how changes in variables impact the overall net present value.

Intuitive User Interface: Experience a clean and intuitive interface designed to enhance usability. Effortlessly navigate through the app, input data, and view calculated results in a clear and organized manner. Streamlined controls make financial analysis a breeze.

The NPV Calculator is your go-to tool for evaluating investment opportunities and making informed financial decisions. Simplify your financial analysis and empower yourself with accurate NPV calculations. Download the app today and unlock the potential of your investment ideas!

Note: The NPV Calculator is a powerful financial tool that provides approximate calculations. Please consult with a qualified financial advisor for personalized advice on your investment decisions.

NPV Calculator App – Easy To Use in 5 Simple Steps

NPV Calculator | IRR Calculator

CAGR Calculator | Reverse CAGR Calculator

Learn Personal Finance

Check out our new venture multipl !