NPV vs IRR: What are the similarities and differences between NPV and IRR?

NPV (Net Present Value) and IRR (Internal Rate of Return) are important tools in finance for figuring out if projects that need investment are worth it. They help us see if a project will make money in the long run. Even though the main ideas behind NPV and IRR are straightforward, they can be a bit confusing for some. In this article, we’ll take a closer look at NPV vs IRR to make things clearer.

What is NPV or Net Present Value?

We’ve talked about NPV or Net Present Value in Finance before. Now, let’s break down what NPV really means.

Understanding NPV in Finance: What is NPV or Net Present Value?

NPV, which stands for Net Present Value, is a fundamental concept in finance.

Before delving into the details of NPV, let’s establish some basic finance concepts.

Conceptually, a dollar received today holds more value than a dollar received in the distant future. This is because investing the dollar today allows it to grow over time. This concept is known as the “time value of money.”

The Time Value of Money

The time value of money refers to the notion that money available in the present is more valuable than the same amount of money in the future. This is due to the potential for the present money to generate interest or increase in value over time.

Present Value

Now that we understand that a dollar today is worth more than a dollar received years later, it becomes evident that the value of money diminishes over time.

When planning a business or investment, it is essential to project the cash flows expected in each year. However, an upfront investment is required to initiate the business. As a result, cash is distributed across various years, from year 0 to year 5. How do we compare these amounts?

By considering the time value of money, we can estimate the present value of future cash flows in terms of today’s dollar value.

To estimate the current value or present value of future cash flows, an adjustment factor known as the “discount rate” is applied.

The Discount Rate

The discount rate is not a universal constant. It varies depending on the context and is used to calculate the present value.

A helpful approach to determining the discount rate is considering alternative investment options and their expected returns given a similar level of risk. For instance, individual investors might consider the expected returns of investing in an S&P500 Index ETF, while a venture capital fund might have different risk tolerances and, consequently, a distinct discount rate.

The discount rate is applied to future cash flows to approximate their value in today’s dollar terms.

Calculating NPV

With an understanding of the time value of money and the use of a discount rate to evaluate future cash flows as present values, we can now ascertain the net present value.

- Upon making an investment today, we already know the present value of that investment.

- By applying the discount rate, we can calculate the present value of all future cash flows.

All dollar amounts are now in terms of today’s value. To calculate the net present value, we sum the present values of future cash flows and subtract the initial investment.

And there we have it – the net present value.

To simplify these calculations, an NPV calculator can handle all these complicated computations efficiently and easily.

NPVcalculator.net

NPV Example

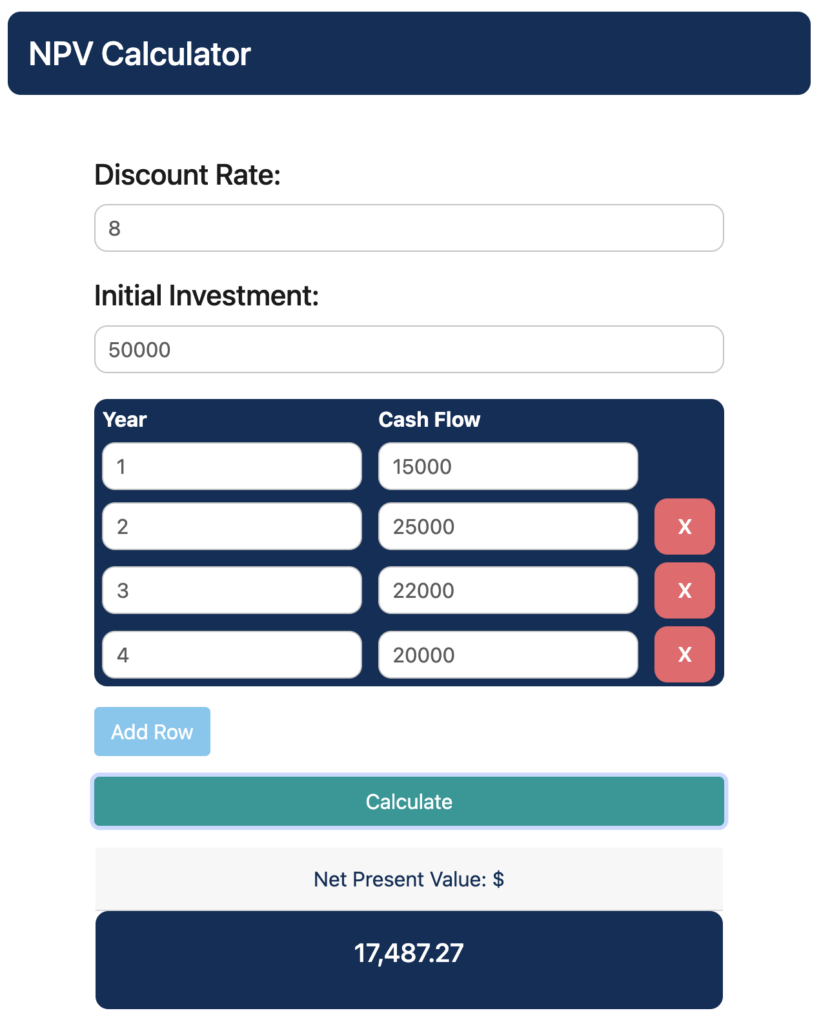

Imagine I’m buying a business for $50,000 today, and I have that money ready. If I decide not to buy the business, I can invest the $50,000 in the stock market and hope for an 8% yearly return.

Now, for the NPV calculation, my starting investment is $50,000, and the discount rate is 8%. The business is expected to make money (profits) for me over the next 4 years.

- year 1: 15000

- year 2: 25000

- year 3: 22000

- year 4: 20000

Using the NPV Calculator is simple. You just need to type in these numbers and click the ‘Calculate’ button. Then, you’ll see the NPV for the business purchase.

The NPV, which stands for Net Present Value, is $17,487.27. This means that if you buy the business, you can expect to make more money compared to investing in the stock market with an 8% annual return. So, because the NPV is a big positive number, it’s a good idea to move forward with the plan to purchase the business.

What is IRR or Internal Rate of Return?

We have already discussed what IRR or Internal Rate of Return is here. Let’s understand IRR.

What is IRR or Internal Rate of Return?

IRR, an acronym for Internal Rate of Return, is a crucial concept in the realm of finance. It represents the return on investment achieved when a project reaches its breakeven point, meaning that the project is only marginally justified as valuable.

To gain a comprehensive understanding of IRR, it is essential to grasp another fundamental concept known as NPV, or Net Present Value.

When NPV demonstrates a positive value, it indicates that the project is expected to generate value, thereby receiving approval from management to proceed. Conversely, if NPV shows a negative value, management will likely decide against moving forward with the project.

In essence, IRR signifies the rate of return attained when the NPV of the project reaches a neutral state, precisely at the point where NPV breaks even.

NPVcalculator.net

IRR Example

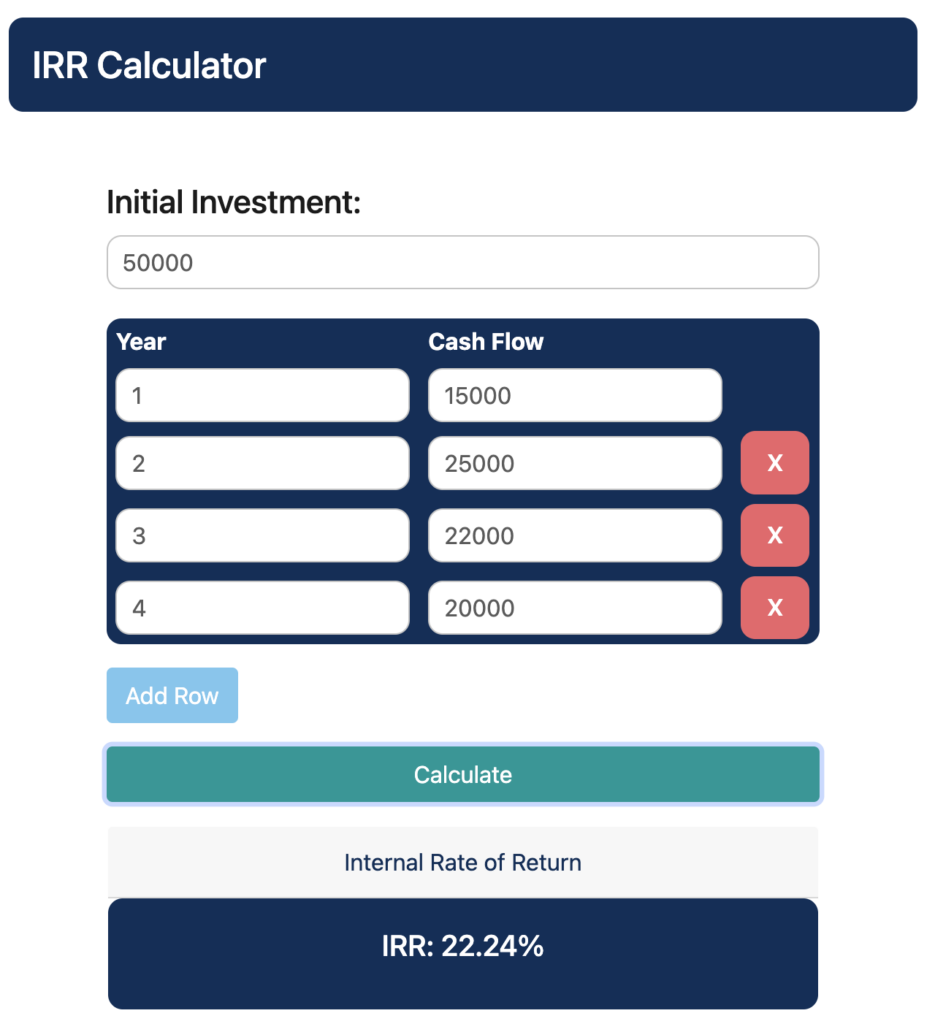

Sure, let’s use the same example of buying a business for $50,000, like we talked about before.

I have $50,000 in cash, and I want to use it to purchase a business. I’ve estimated how much money the business will make over the next 4 years.

- year 1: 15000

- year 2: 25000

- year 3: 22000

- year 4: 20000

Let’s figure out the Internal Rate of Return (IRR) for this investment using the IRR Calculator. You can enter the initial investment and expected cash flows, then click ‘Calculate’ to see the result.

Here, I notice that the IRR (Internal Rate of Return) is 22.24%. This means the profit I could make from this investment is higher compared to the 8% return I was hoping for in the stock market. So, I think it’s a good idea to move forward with my plan to buy the business.

NPV vs IRR: Differences

- Representation:

- NPV (Net Present Value) shows the value in money, like dollars or euros.

- IRR (Internal Rate of Return) shows the value as a percentage.

- Help With Decision Making:

- NPV, being in money terms, makes decisions easier. A project with a $1 million NPV is better than one with $100,000 NPV, assuming everything else is the same. It helps compare different projects and decide which is more profitable.

- IRR, in percentage terms, can be a bit confusing. It’s hard to tell if a project with 20% IRR is better than one with 18% IRR, especially if they have different investments. Checking the NPV alongside IRR is useful to make a more informed decision.

- Requirements For Calculation:

- NPV needs initial investment, a discount rate, and cash flows.

- IRR needs initial investment and cash flows. The discount rate isn’t necessary, but it can be helpful for comparison once you’ve calculated IRR.

- Single vs Multiple Results:

- NPV gives a single result for a given set of inputs.

- IRR, in cases with irregular cash flows, can sometimes have multiple results because of both positive and negative cash flows.

NPV vs IRR: Similarities

Here are the three key similarities between NPV and IRR

- NPV and IRR help us make money decisions in different ways.

- To use NPV or IRR, we need details about how much we invest at the start and our expected future cash earnings.

- Basically, higher values for NPV and IRR are good indicators.

NPV Calculator Online

You can calculate the Net Present Value online on this site, using this link:NPV Calculator

Alternatively, you can calculate the Net Present Value online on our partner site, using this link: NPV Calculator

IRR Calculator Online

You can calculate the Internal Rate of Return online on this site, using this link: IRR Calculator

Alternatively, you can calculate the Internal Rate of Return online on our partner site, using this link: IRR Calculator

NPV Calculator App

You can download our NPV Calculator app on the Apple App Store for your iOS devices.

IRR Calculator App

You can download our IRR Calculator app on the Apple App Store for your iOS devices

To Wrap Up The NPV vs IRR Discussion

We hope this article about NPV vs IRR made it easier for you to grasp how they are alike and different. Usually, when people plan projects or invest in something, they use both NPV and IRR to get a full understanding. This helps them decide whether to proceed with the project or investment (‘go’) or (‘no-go’).