NPV of Perpetuity can be calculated by using a simple formula if the yearly cash flow amounts remain constant.

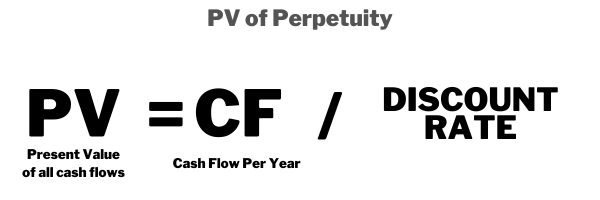

Present Value or PV = Cash Flow / Discount Rate

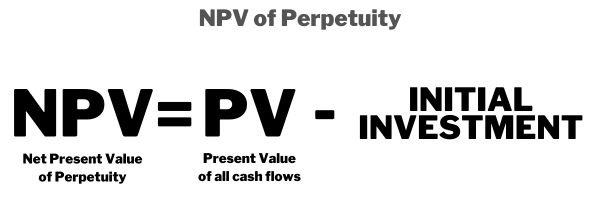

If you have to make an investment today (at year 0) for the perpetuity to generate the yearly cash flows, the NPV of perpetuity can be calculated as follows:

NPV of Perpetuity = PV of perpetuity – initial investment

or,

NPV of Perpetuity = Cash flow / Discount Rate – initial investment

NPV of Perpetuity: Example 1

Suppose there’s a project idea that requires a $80,000 investment and it will generate a $20,000 yearly cash flow forever (in perpetuity). The discount rate is 10% for this project.

So, here the PV of perpetuity = $20,000 / 10% = $20,000 / 0.10 = $200,000

Initial investment = $80,000

NPV of perpetuity = $200,000 – $80,000 = $120,000

NPV of Perpetuity: Example 2

Suppose there’s an investments scheme that requires a $200,000 initial investment today, and it will generate a $35,000 cash flow per year forever (in perpetuity). The discount rate is 8% for this investment.

So, here the PV of perpetuity = $35,000 / 8% = $35,000 / 0.08 = $437,500

Initial investment = $200,000

NPV of perpetuity = $437,500 – $200,000 = $237,500

NPV Calculator | IRR Calculator

CAGR Calculator | Reverse CAGR Calculator

Learn Personal Finance

Check out our new venture multipl !